About EnlightenESG

A growing global conscience is moving our world towards Sustainability.

About EnlightenESG

A growing global conscience is moving our world towards Sustainability.

ESG, or Sustainable Investing, is set to become the standard. Yet, to truly succeed, advisers, clients, corporations and employees must become enlightened to what ESG means to them.

Without an effective profiling solution to assess clients’ sustainability choices, clients may be left in the dark and advisers left uninformed. We identified a need for an open, accessible, and standardised suitability profiler that ensures a positive solution for all. So, that’s what we created. In doing so, we make a small but meaningful contribution to the successful adoption of Sustainable investing.

EnlightenESG is our open commitment to ensuring that Sustainability meets suitability. It protects advisers and clients by helping them to make better choices, through intelligent profiling of appetites and attitudes to sustainability. In the process, it also supports the continued adoption of positive investing.

OUR PURPOSE

To enlighten advisers and their clients on ESG investing choices

Our Philosophy

What does ESG really mean to “me”?

There is no question that technological disruption and societal change can lead to outstanding investment opportunities.

Arguably, there is no bigger and more important change than transitioning global societies to a fairer, more diverse and sustainable future. However, with something so emotive and so fundamental to all our lives, it can be easy to get caught up in the debate or drowned in the tidal wave of opinions and as a consequence, lose sight of what Sustainability really means to us as individuals.

Learn more about the EnlightenESG philosophy:

It is becoming increasingly clear that we are starting to be sold the ESG story.

ESG products, marketing and Sustainability rhetoric is everywhere and there are signs the rhetoric is now changing from “the positive impact” we can make as investors to a more self-serving rhetoric of championing returns and “once in a lifetime” investment opportunities. There is a risk that ESG and Sustainable products and messaging could themselves become industrialised.

We should not necessarily see this as a negative, because the universal acknowledgement of the financial services industry’s responsibility for achieving a sustainable future is a good thing. However, the championing of outsized returns, coupled with ESG-related government and regulatory support may lead to the assumption that anything with an ESG label is good for us.

This, in turn, has the potential to lead to a mismatch between the time frame within which sustainable goals are achievable and individuals’ shorter-term goals. So, where does the intersection between Sustainability and suitability lie?

Understanding where sustainability meets suitability in our view is critical to ensuring the success financial services will play in championing and allocating rational capital – which ultimately ensures companies understand the importance of meeting all their ESG responsibilities.

It is critical that businesses, industries and management all understand what is important to us as shareholders. However, as individuals, to effectively vote with our wallets we have to understand and quantify what is important to us, we need to put sustainability in the context of our own long-term and personal goals.

Products need to not only be sustainable but also suitable… can sustainability simply trump suitability?

If ESG products’ objectives and risks are not clearly understood or in line with individuals’ risk attitudes, then, regardless of the products’ sustainability, it is likely the supporting capital may not have the required patience to succeed. If we lose trust in the products the financial services industry offers, we may see irrational capital chase returns or, even worse, irrational product offerings.

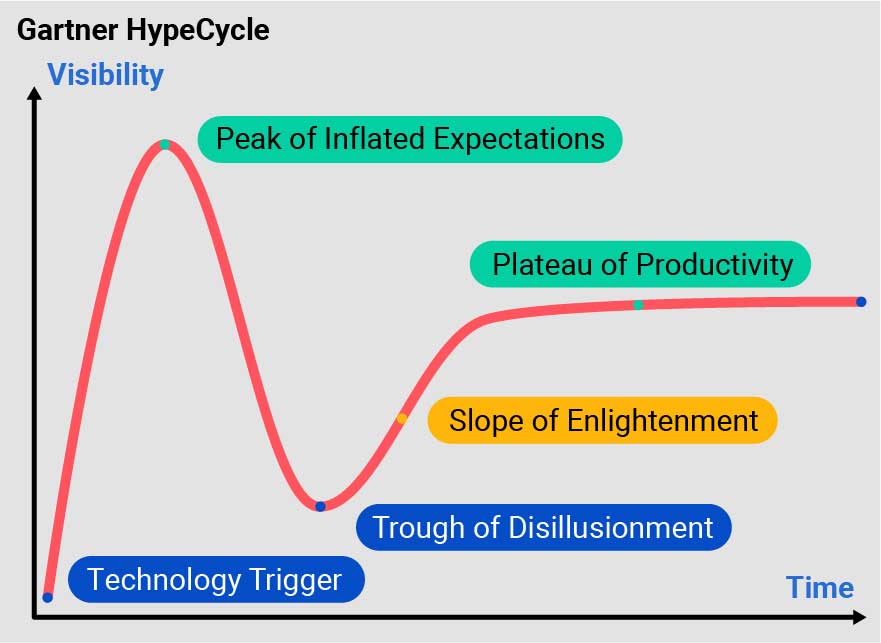

Gartner, a world leading research and advisory company, created the concept of the HypeCycle, which establishes the expectation that most innovations, services and disciplines will progress through a pattern of overenthusiasm and disillusionment, followed by eventual productivity.

Gartner argues that a technology trigger “in this instance ESG” can lead to large amounts of capital chasing themes, resulting in over optimistic short-term outcomes (i.e. the 2000 tech bubble). The bubble eventually bursts, and this is followed by a “trough of disillusionment” leading to a big supply shake out and then a more gradual period of prolonged growth that Gartner call the “slope of enlightenment”!

Exciting marketing, new technologies and mega trends often lead people to overestimate the short-term opportunity whilst at the same time underestimating the long term benefits. As a consequence, end investors often miss out on participating in this long-term success as they have shaken out the volatility associated with what Gartner call the “HypeCycle”.

Sadly, the planet and society, simply can’t afford a “trough of disillusionment” that could cause a lost decade of investment in this progressive “movement” towards sustainability.

It is education that will be the key to prolonged rational capital allocations to the sustainable investments that can ultimately make a difference.

We are on this “Slope of Enlightenment,” an upward trajectory of positive change. There will be bumps in the road, there will be winners and losers of this secular societal transformation, but to keep this going we must make sure individuals, financial planners and employers understand what suitability means to them, their clients and employees. There are only good choices if ESG and sustainable investing is viewed through the lens of suitability and a robust risk framework. Education will lead to rational and patient capital allocations that can truly make a difference.

That will allow us all to continue on this critical – and what must be – prolonged “Slope of Enlightenment”.

Why EnlightenESG

EnlightenESG’s aim is to help people to understand what Sustainability in investing means to them. In the context of “my investment”, however big or small, what does ESG really mean to “me”?

Sustainable Investing is investing to make a difference and selecting investments that exhibit better characteristics for the environment, the world and its inhabitants. However, it is a place fraught with jargon, complexity, and risk.

The EnlightenESG tool helps to personalise the investment journey. We are done believing that the investment community always has in its heart a will to do what is right for each client, as opposed to sell its wares.

This is important, as instead of pushing product on people that simply want to invest for a better future, we try to understand exactly how each individual thinks about sustainability. Our view on these huge issues is deeply personal, so why can’t our investments be?

Using a series of questions, we map a unique profile to each user in our tool. The tool can highlight how you express your Sustainable goals, whether you are interested in a particular area of sustainability or the potential risks associated with your decision making.

This structure helps your financial adviser map you to a product that is Sustainable and Suitable. This is important, as it means that unexpected outcomes are less likely.