We say goodbye to 2021, a year punctuated by a continuation of the Coronavirus Pandemic, market volatility and renewed worries about inflation, but there was at least one piece of good news: sustainable investing cemented its place on the investment landscape.

Whilst it is difficult to assess just how large the assets in Sustainable Investing are, the Global Sustainable Investment Alliance’s latest estimate is that it could be as large as $35.3tn (USD), a 15% increase in the past two years and over a third of all assets under management. Bloomberg puts asset growth in ETFs alone at 69% across both equities and debt globally. So it is not an exaggeration to say that Sustainable investing has reached the mainstream, not only in terms of asset flows but also of macroeconomic thought, as policy around combating climate change and social change become important for all market participants to understand.

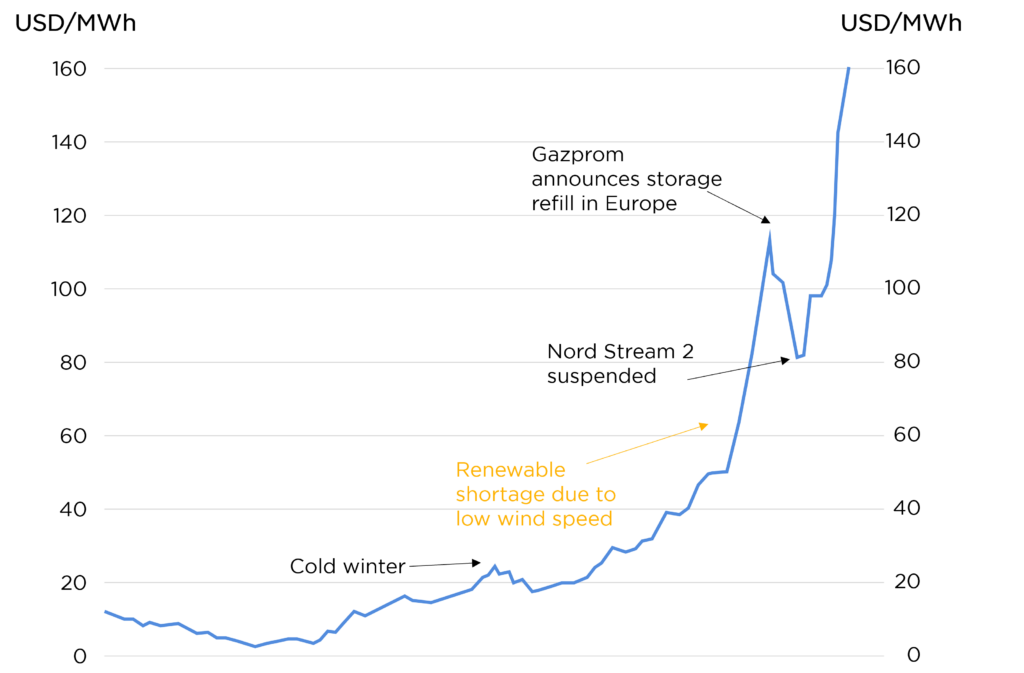

The year also saw market volatility, as inflation reared its head, firstly through supply chain disruption which then broadened to other components of inflation indices. Indeed, in Europe we saw the emergence of an energy crisis. Some of this can be attributed to the revolution in Sustainability, less inclination to invest in oil, natural gas and coal production has reduced capacity, whilst the investment in solar, wind and hydropower has not been enough to offset this reduction in energy production. The other issue for energy markets is storage of non-consistent energy flows. It isn’t sunny, nor is it windy all the time, and therefore ensuring that the grid has ample capacity during periods of higher demand is important for the future of renewables. We think, that structurally the shift towards renewable energy sources will cause an uptick in power price volatility and possibly inflation over the coming decades if governments commit to their plans as laid out in COP 26, however we view it as necessary given the challenges faced by inaction.

Average Weekly Price of European Gas

Source: Goldman Sachs Investment Research, Bloomberg

The pick-up in inflation led the major central banks to change tack in the final few months of 2021. Concerns that the rise in inflation would be longer lasting has meant that it is likely we will see interest rates rise, and central bank balance sheets reduced through 2022. This has the effect of tightening financial conditions and has also begun to spook some parts of equity markets.

Inflation and Sustainable assets

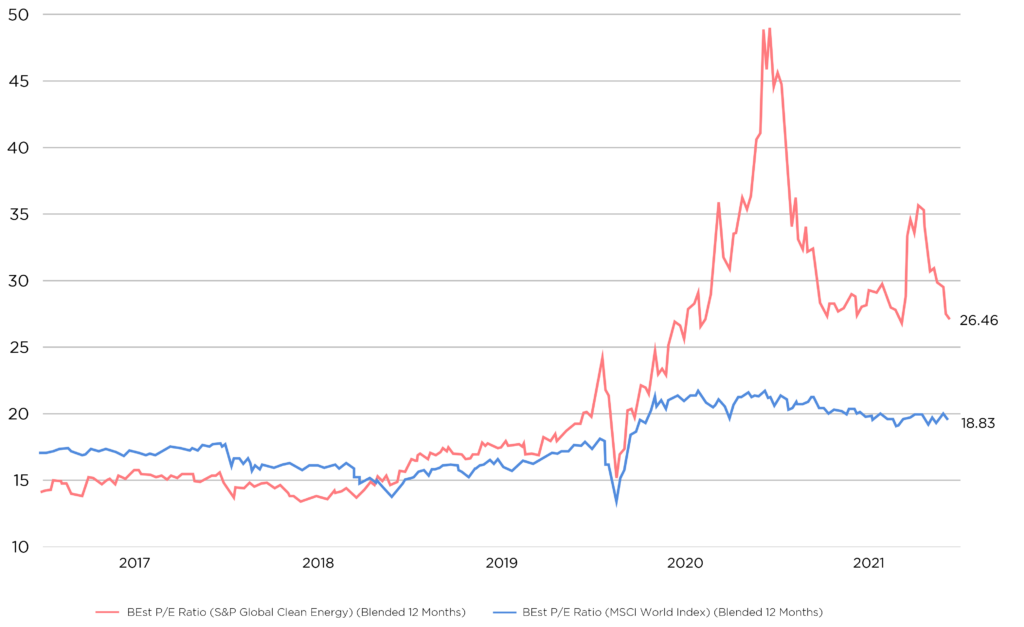

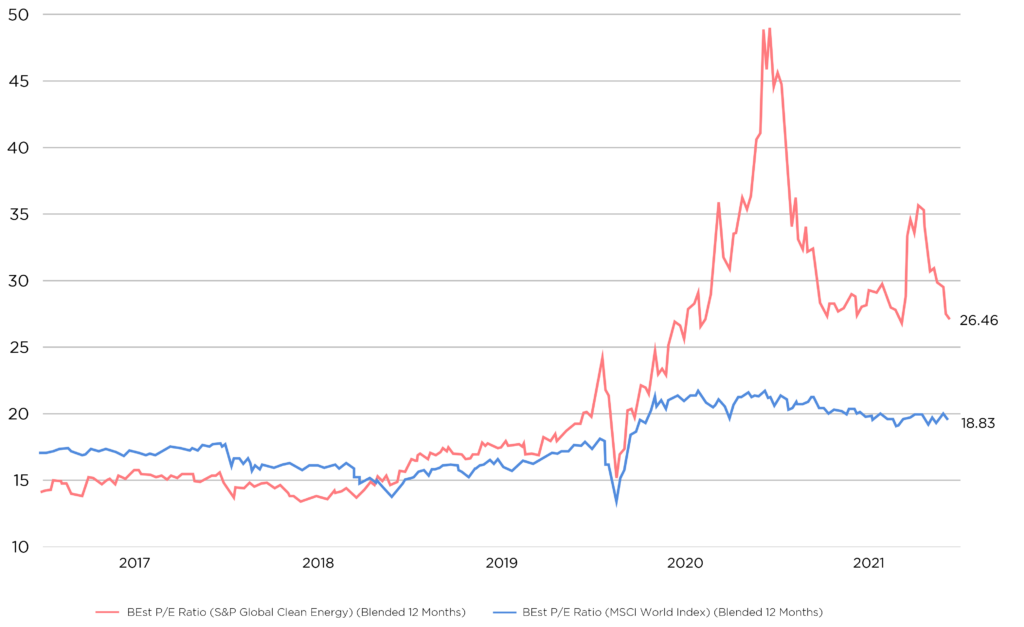

We saw some of the speculative end of the Sustainable Investing universe begin to underperform broad equities in 2021, which was a concern of ours heading into 2021. Fuelled by cheap money, and the excitement of the emergence of Sustainability as a theme, we felt that pockets of the market got ahead of themselves in 2020, when themes such as clean energy stocks returned upwards of 134%!

Inevitably, markets tend to overreact in the short term, and we were not surprised to see, as the narrative of the Fed evolved, that these same stocks would come back down to earth, falling 27% in 2021, a year when global stock markets were up 23%.

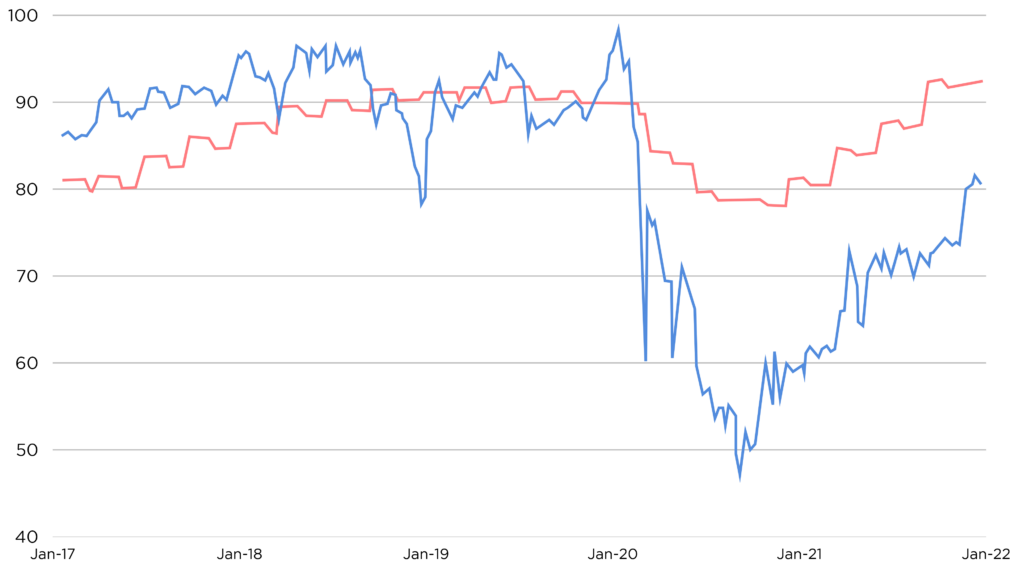

The valuations for these stocks had reached extremely elevated levels as shown in the chart below of the forward P/E ratio of clean energy:

P/E Ratio of Clean Energy

Source: Bloomberg

Through 2021, we focused on areas such as social change, with companies that are thinking carefully about the fact that people are living longer, and that social change is occurring within geographies. Companies that can help combat these structural issues are not only Sustainable but also forward thinking. For us these underrepresented themes offered more attractive value than some of the other areas of the Sustainable market.

So what is there to buy?

We think there remains structural support for assets and companies that are focused on delivering their products in a more sustainable way. We feel however, it is important to remain focused on valuation of the themes and companies that we gain exposure to, as the support from flows into Sustainability cannot offset a challenged valuation. That is why our approach is to try and identify under-represented themes within the portfolios. This can include areas such as physical infrastructure involved in power production (ie solar fields), where we see support for assets that are linked to climbing power prices and are protected from the impacts of inflation on their earnings.

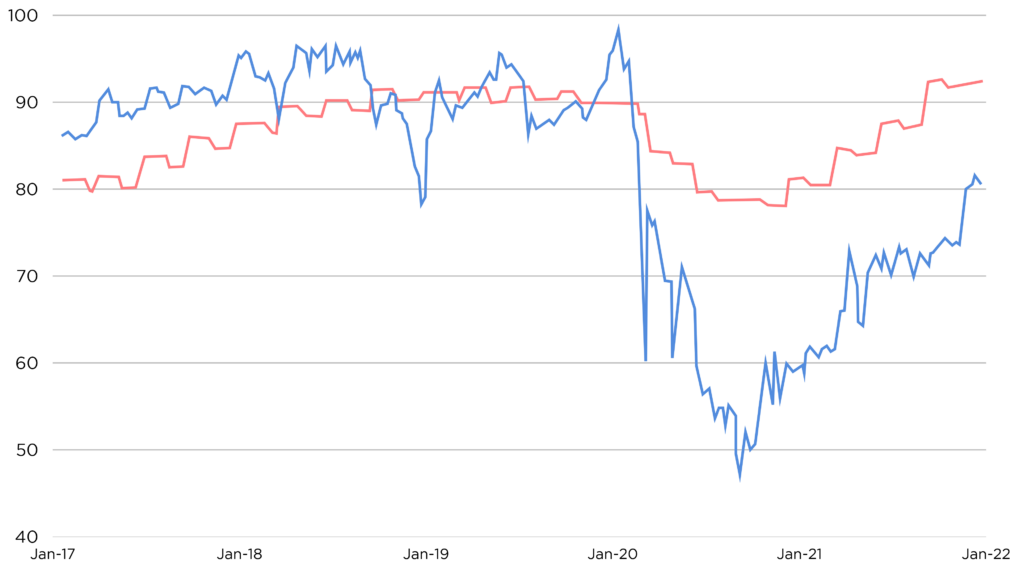

We also gain exposure to infrastructure via physical property. These vehicles are primarily exposed to the industrials sector, with some exposure to retail warehouses and offices and almost no exposure to high street shops. The property company we have invested in trades at a significant discount to the net asset value of the underlying buildings themselves, despite strong returns from the industrial sector and retail warehouses and a stabilisation of the office sector over 2021. We think a combination of discount closure, yield return of over 4% and an increase in the value of the properties could drive very strong returns.

Managing offices, infrastructure and other physical property assets is not, on first appearance, linked to Sustainability. But 17.5% of emissions globally is a result of heating and cooling buildings, and therefore investing in selected property companies that focus on sustainable building maintenance is interesting for us. The ESG strategy of this vehicle is multi-faceted, and we believe over the past few years they have become market leaders in the property space in terms of incorporating ESG into the investment process:

- Purchased 1,447 hectares of land to sequester approximately 195,630 tonnes of carbon up until 2060, representing 73% of the Company’s residual embedded and operational carbon.

- Through 2020 and 2021 the fund has attempted to utilise solar power on its industrial buildings.

- These now total 6 projects, and have saved emissions worth 3,000 houses, with 20 more planned.

- Improve ESG through data visibility.

- Signing a net zero commitment – as such this vehicle will transition to net-zero carbon emissions out to 2050.

Source: Numis

Conclusion

Despite uncertainty around inflation, the Federal Reserve and Coronavirus, 2021 was positive in terms of markets, and in terms of the support that we saw for Sustainable solutions. As we look out to 2022, we believe that Sustainability as a theme will only become more important for market participants. However, it is important to be both selective and diversified when investing in sustainable assets. We continue to find opportunities in under-represented Sustainable assets within the portfolio that represent good value and haven’t been inflated by the expansionary monetary and fiscal policy that has characterised the past two years.