2020 was a year of superlatives: the fastest fall in equities from a peak on record; the largest global stimulus package; the biggest fall in UK GDP for 300 years. We hope and expect that markets will be less volatile in 2021.

In this piece, we want to focus on the environmental aspect of sustainable investing, and to think about how policy is shaping the way we transition to a lower carbon world.

2020: An historic year

In 2020 the human cost of the Coronavirus pandemic rightly dominated headlines, but in terms of the environment, 2020 was also the joint hottest in terms of temperature ever recorded, had the highest incidence of named hurricanes (30) and was the fifth most extreme in terms of wildfire losses. All of these served as a stark reminder of the impact of human activity on our planet.

What is sustainable investing?

Sustainable investing is a catch-all term for investing in a way that accounts for being socially responsible and investing ethically while also seeking returns.

The term sustainable investing is often used to capture the various methods of incorporating concerns around Environmental, Social and Governance (ESG) issues into our investment decision making processes.

A commitment to responsible investing

Some Asset Managers will be signatory to the UN PRI Principles for Responsible Investment, this is way for firms to publicly stated their support for the better understanding of the investment implications of ESG factors.

These firms must constantly strive to be a more responsible firm both in how they operate and but how they manage clients’ investments.

Governments are waking up to the costs of carbon

One of the areas where we saw continued commitment to change the course of the next few years is through government policy.

United States

The election of Joe Biden as the 46th President of the United States reset the US environmental agenda – Biden has prioritised re-joining the Paris agreement on climate change and has also set net-zero carbon emissions targets to 2050. Given the recent Senate runoff result in Georgia, which has meant that the Democrats control both houses as well as the White House, we are likely to see enshrined into law some of the longer-term green goals in Biden’s plan. The scope of this U-turn in the US government cannot be understated, as Trump overturned over 100 environmental rules and regulations during his tenure.

Europe

Closer to home, one of the largest commitments in government policy we saw over 2020 was in the EU, where policies focussing on environmental change formed a core part of the fiscal stimulus deal that resulted from Coronavirus. The ‘Next Generation EU’ fiscal stimulus package, designed to counter the negative economic impact of Coronavirus was €750 billion for the year. Of this, €250 billion will be made available to member states for spending on green infrastructure projects. This is not a one-off investment either, with 30% of the EU’s budget to 2027 planning to be spent on similar projects. European Commission President Ursula von der Leyen said: “The recovery plan turns the immense challenge we face into an opportunity, not only by supporting the recovery but also by investing in our future: the European Green Deal and digitalization will boost jobs and growth, the resilience of our societies and the health of our environment.”

China

China, often maligned as not doing enough in terms of Carbon usage has also planned to be carbon neutral by 2060, aiming to reduce oil and natural gas usage by 25% by 2025. This is ahead of the vital UN Climate Summit called Cop26 to be held in November 2021, seen as a last chance for nations to meet the targets designed to prevent material global warming from here.

The big question

How will governments be able to meet these targets on emissions reductions?

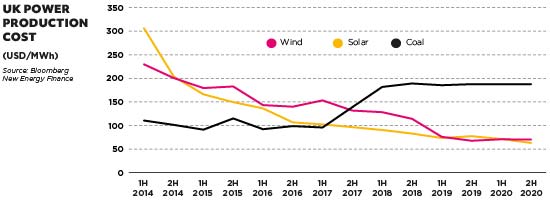

One of the ways to achieve this is through increasing investment in green energy, and we see from the below chart that costs (using the UK as an example) of using solar and wind power to generate electricity have fallen materially over the past 5 years:

This price drop reflects not only government investment, but also scientific endeavour improving the efficiency of these alternative power producers. Bloomberg estimates that governments globally invested over $500bn into energy transition in 2020, a 9% rise on the previous year and more than double the figure invested in 2010.

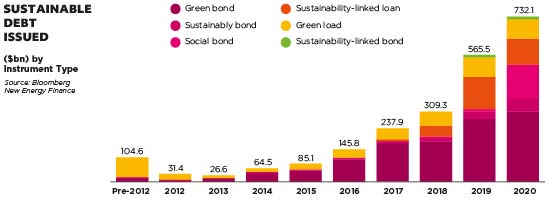

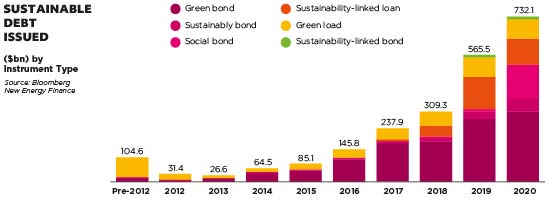

Governments, and other multinational institutions are not just funding this through direct spending. Green Bonds are emerging as a way of funding infrastructure and climate related projects. These bonds are asset backed and are often independently certified to prove the proceeds are being spent on appropriate projects. Since 2008, the World Bank for example has issued over USD 13 billion equivalent in Green Bonds through more than 150 transactions in 20 currencies, and they estimate that through this project they have taken the equivalent CO2 of 7.6m cars off the road. We see from the below that Green Bond issuance continues to rise, as more multinationals and governments utilise this method of funding initiatives:

Conclusion

Carbon transition is vital to the planet, and therefore forms an important theme within sustainable investing. Governments have taken steps in 2020 to counteract the negative impact of excess carbon usage on the planet, and if these trends continue, we should see them reach long term carbon neutrality.

Scientists at a recent Reuters conference estimated that at least $1tn of further investment capital is needed per year to reach the target of net zero carbon emission through both private and public markets. Sustainable investing provides the opportunity for return whilst supporting this vital transition to a zero carbon world.

Please note the content of this article is provided for general information only. It is not intended to amount to advice, advisory, tax or other professional advice, consultation or service.

Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up-to-date.